Adding value to your new investment

Congratulations! You have just taken ownership of your new property investment…

But now, how do you go about adding value to your property so you secure the best returns?

In this article, I’m going to share with you what you need to know about when it comes to:

- Where to start when adding value.

- The biggest profit maximisers in adding value you should be thinking of.

- Some of the most expensive and ‘time-sink’ strategies you need to avoid.

If you are interested in getting the most value out of your property investments, check out these tips on using interior design from myself and Bernie Woods!

First Steps

The first step for any property investment we make at Premier Property is to make sure you make money when you buy.

Here’s the thing - many investors get stuck because they buy a property, but unfortunately can’t do anything with it or the works are too expensive.

You want to make sure that your property investment will be making money from day zero.

So how do you assess this?

Step 1:

Firstly, identify the target market of your property. Think about who is likely to want to live in this area, and in this home.

A family with children will want very different things to a group of young professionals, so make sure the property itself appeals to the same demographic as its location.

Demonstrating the use of a spare room as a bedroom, office space or home gym to the right buyer helps the buyer visualise the property as a home, increasing your chance of a sale.

Make sure your target market lines up with your property strategy. The people who might buy a property are not the same people who might rent it!

If it isn’t already, can the property be made suitable for your target market and strategy?

It’s much easier to adjust your target demographic than your property strategy, as thelatter can be financially messy. Your cashflow for a to-let will be totally different to the cashflow of a to-sell, so know your strategy and stick to it.

Step 2:

Firstly, always take the time to find a great builder for any major project. Ask friends and business contacts for recommendations and use online resources to find tradespeople. Sites like Checkatrade.com and MyBuilder.com should be your first port of call, be sure to check multiple comparison sites when possible.

Of course, that doesn’t mean you shouldn’t do your own due diligence as well, I'll be sharing some pointers on assessing credible tradespeople in more detail in a later article!

Step 3:

Get the property fully surveyed for any structural damage; you really don’t want the hassle of only finding something like this halfway through a major renovation!

It’s not that you can’t make money on a property like this, in fact many people go out of their way to find these ‘fixer-uppers,’ but you need to know what you are getting into, preferably before you buy!

Step 4:

All of the cosmetic flaws and faults in the property should be thoroughly investigated as well, as they might be hiding more serious issues. There might be damp behind the peeling wallpaper, and that mismatched paint in the corner could be hiding a serious mould problem.

Step 5:

Similarly, check all services such as wiring and plumbing are in good condition.

Always think in worst case scenarios here – the tap that doesn’t work might just need to be reconnected to the water supply, but what if it was disconnected because the pipes connecting it leak?

That is not something you want to find out right after spending thousands on renovation!

In short, do everything that can do done to be as certain as possible that later work will not be interrupted to deal with these types of problems, and that there is no chance for an undetected problem to cause damage later on.

One key tip which will save you tens of thousands of pounds is to make sure your terms are clear with the builder from day one.

We’ve all heard the horror stories of a simple miscommunication or misunderstanding that led to hugely expensive mistakes, so don’t let it happen to you!

Getting a botched job fixed can be expensive and will play havoc with your schedule. This is mostly down to you making sure your builders have the right instructions, but having a builder you can trust is one less thing to worry about.

Major Projects

Now that the groundwork is done, let’s talk about making some improvements to maximise your returns.

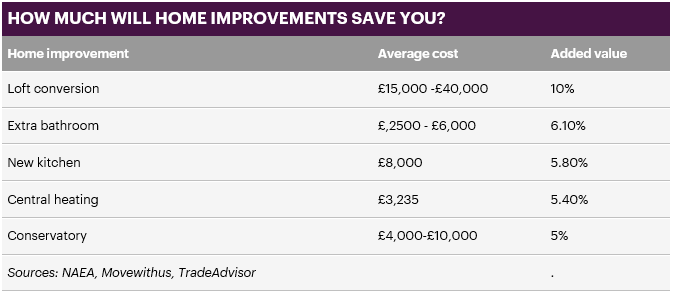

A new kitchen can greatly improve the likelihood of a sale. The kitchen is one of the most important rooms in the property for many buyers, and is usually the first room a new owner will look to refurbish.

Save them the hassle and provide a modern, attractive kitchen they can start using straight away. The prospect of having to handle a major renovation themselves can put off even the keenest buyer!

The average kitchen costs around £8,000, and adds 6% in value to the property. Many builders recommend kitchens by Howdens and Magnet, if you can arrange supply through the builder they will likely get it cheaper on a trade account.

If you can do it without eating into living space too much, creating a new bedroom can add significant value.

A loft conversion could cost between £20,000 and £40,000 depending on the scale, and can add as much as 10% to the value of the property.

Make sure your insurer knows about the changes!

Adding a bathroom can be a great way to improve the value of a property, especially en suite bathrooms.

A new bathroom could cost between £3,000 and £6,000, and will increase the value of your property by up to 6%.

As a general rule, try to maintain a ratio of at least one bathroom for every three bedrooms.

Extensions can also be a worthy investment; just make sure they add a decent amount of space, and don’t clash with the original construction.

Conservatories are a fairly common extension which can add up to 5% to the value of the property, as long as you don’t take up too much garden space building it.

Expect to pay between £4,000 and £10,000 depending on the design. For smaller conservatories you may not need planning permission, which can reduce costs.

Almost two thirds of garages in UK homes do not contain a car, so converting wasted garage space into living area can be a very cost effective way to add value to a property. You might not need planning permission for this, but you will still need to comply with building regulations.

Though garage space does not appeal to the majority of buyers, parking space does.

If the property allows, the cost of turning an unused front garden into a parking space large enough for two cars is around £10,000, and in areas where parking space is at a premium could return double that investment.

Finishing Touches

It is also worth mentioning all the little details that might not add a huge amount of value to the property, but can make a sale at the right price just that little bit easier to get.

First impressions are vital, so replace that worn front door and put fresh paint on the window frames.

A claustrophobic hallway can turn off a buyer as soon as they step through the door, so hang a mirror to widen the sense of space.

Buyers are often on the lookout for convenient storage space, so creating storage areas under the stairs, in the bathroom or anywhere else there is an opportunity to do so is a cheap and easy way to increase appeal.

Dos and Don'ts

Finally, here are a few quick tips that don’t quite fit into the above categories, but are worth knowing:

Do:

- Keep original and interesting features. Memorable quirks like wooden beams, vaulted ceiling and frameless conservatories give the property character and make it stick in the minds of potential buyers.

- Update the property with modern heating and double-glazing – just don’t get rid of those period windows!

- Remove ugly or outdated features such as textured wallpaper and ceilings.

- Get planning permission. It reassures potential buyers and costs around £300.

Don’t:

- Convert the basement. It doesn’t appeal to a lot of buyers, costs upwards of £300 per square foot, and will require the organisation of multiple specialists.

- Spend too much decorating and refurbishing bedrooms. While the number and size are important, a well-decorated bedroom is not likely to greatly raise the price or improve chances of a sale.

- Spend too much on furniture in general. As long as furniture is in good condition and suits the property, that time and money is better spent elsewhere.

- Outgrow your area. By pricing out most of the people looking in your area, you risk having a vacant property on your hands, or making a loss on the deal. Stay within the means of your target market.