Everything you need to know about the interest rate rise

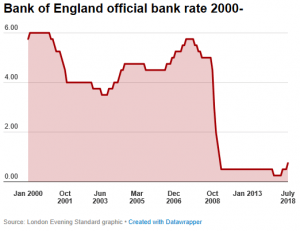

The 9 members of the Monetary Policy Committee came to a unanimous vote yesterday to raise interest rates from 0.5% to 0.75%, hiking rates above emergency levels for the first time since the 2007 financial crisis. The hike has been anticipated for some time and is not expected to have a drastic financial impact for most people. Investors and developers in the Premier Property community are already adapting to the expected changes, as we have been following the issue and keeping on top of the latest information. This article will help to explain what is happening, and how it might affect you.

The 9 members of the Monetary Policy Committee came to a unanimous vote yesterday to raise interest rates from 0.5% to 0.75%, hiking rates above emergency levels for the first time since the 2007 financial crisis. The hike has been anticipated for some time and is not expected to have a drastic financial impact for most people. This article will help to explain what is happening, and how it might affect you.

Many are expecting to see further rises over the next few years, with the base rate predicted to level out at around 2% or 3%, although not in the immediate future. This is due to the UK economy having improved over the last few years and more recently wages beginning to increase, leading to the MPC’s decision to increase interest in order to curb inflation, in addition to taking the opportunity to create room for rate cuts in the event of another financial crisis. The decision has been regarded as a positive move so far by the majority of the banking sector, although critics argue the timing is premature given the continued threat of a ‘No Deal’ Brexit scenario. It has been speculated however that a ‘No Deal’ scenario would simply result in rates being cut back again.

The Property Market

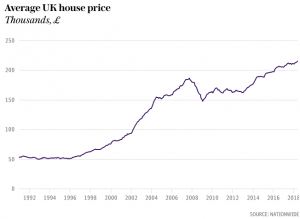

Homebuyers had cautiously returned to the market this summer, attracted by low interest rates and a lengthy slowdown in house price rises caused by the economic uncertainty left by the EU referendum. With over 65 thousand mortgages taken out by homebuyers this June, market activity had defied the summer months’ seasonal slump to reach its highest since January.

That slump is expected to make an appearance in the wake of the interest rate rise however, with subdued sales forecasted for the next few months. The true impact on buying and selling will likely be seen in September, when market activity would typically pick up after the summer lull.

The increase has been expected for some time after being delayed by the blizzards earlier in the year, and some are predicting the recent upturn to be a flash in the pan. Hansen Lu of Capital Economics is expecting the weak demand to continue in the long term as the rising interest in conjunction with high house prices renders the growth of lending in the property market increasingly unsustainable.

How the rise will impact London and the South

The Southern and London property markets will be impacted the most by the interest rate increase, with the London market in particular already hit hard by higher buy-to-let tax and stamp duty in addition to the uncertainty surrounding the post-Brexit trade negotiations. In these conditions the interest rise will likely do little to slow the falling house prices, which is being predicted to result in an increase in home ownership over the next few years, despite the interest hike, and the strong possibility of further hikes in the near future, arguably damaging buyers’ confidence to borrow and take on debt.

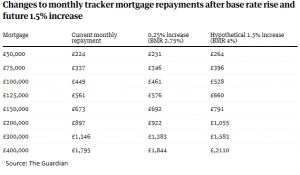

Furthermore, with more than a third of London owners on variable rate mortgages, the hike is expected to affect these mortgage holders in the very immediate future, as banks and lenders are likely to rapidly raise their interest rates in tune with the new base rate. For mortgage holders already at the limit of their budget, the increase represents a significant addition to monthly bills.

The effect of the rise in the Midlands and the North

Due to a widespread increase in the number of owners with 10-year fixed rate mortgages at relatively low interest rates as compared to their 2 and 5-year counterparts, most mortgage holders will be safe from the interest rise in the short term, however they will undoubtedly be looking at higher interest rates at the end of their fixed terms.

The value of property across the North and the Midlands is expected to rise 2-3% on average each year, which is largely a continuation of the current rate of price increase. Some fluctuation in house prices and upsets in supply and demand may be seen, as due to the hike in variable and fixed rate mortgage costs which is likely imminent, some economists are predicting that investors will take advantage of the currently available long-term fixed rate mortgages in order to guarantee a rate before interest rates are increased.

Outside the Property Market

Although some improvement will be seen on the interest rates of savings accounts, there will not most probably be any major increases, as banks tend to utilise such rate rises to widen their interest margins and profits, and are usually slow to reflect base rate increases in the interest rates of their savings accounts.

The price of the Pound dropped sharply after the hike announcement, however this can be expected to bounce back to its pre-hike position as the anticipated change will have been priced in and accounted for by traders.

Finally, it is important to remember that outside of the property market in London, the base rate increase can be expected to be of minor impact, for a number of reasons. Firstly, the rate increase has been anticipated for some time and the affected markets have largely already taken it into account in advance. Secondly, although this hike is a nearly unprecedented fifty percent rise, 0.25% is a relatively small increase considering the length of the freeze on rate increases and the 6% base rate that was in place before the financial crisis, and the banking sector has been keen to iterate that the increase represents a reflection of the UK’s improving economy rather than an alteration to it. Thirdly, with so much dependent of the still uncertain EU trade deal, many markets, the property market included, are likely to reserve major changes for once a definitive deal has been announced, or at least the lack of a deal has been definitively announced.

Great article Kam, thank you!

Really helpful and succinct. Thank you

Great information Kam to help us anticipate the interest rate rises and minimise their effects on our property incomes.

Kam!

As expected,a very well professional analysis of the situation. Thanks.

Great article. So good to see a balanced report on what’s happening.

Great update and explanation of the market, thanks Kam.